Increase Agility and Reduce Repetitive Tasks in Prospecting and Onboarding New, Digital Savvy Clients

One of the biggest time wasters in wealth management is organizing, tracking and performing repetitive tasks. In an industry that’s poised for significant change, increasing agility and automating repetitive tasks is critical in redirecting your energy and effort to evolving client needs.

McKinsey & Company reports that “The North American wealth-management industry will undergo meaningful changes in the next ten years, influenced by evolving customer segments and rules of engagement, rapid technological advances, and shifting competitive dynamics.”

Implementing the right technology enables wealth advisors and financial planners to focus on fundamental changes in the economy that are driving the need for new approaches to protecting assets and planning retirement, and meeting the expectations of increasingly digital savvy clients and staff.

The most efficient and effective way to satisfy customer expectations is by automating redundant work that slows down your prospecting and onboarding tasks with new clients.

Automated Action Plans for Wealth Advisors

Your time is better spent on client engagement, so relying on leading technology helps prioritize and sequence the highest priority tasks. At the same time, it’s critical to train staff and monitor team accountability to deliver high-quality service at every client touchpoint. Automated, clearly defined and easy-to-administer Action Plans are required.

Most standalone financial planning CRMs don’t deliver the pipeline, coaching or accountability platform to meet the needs of digital team and sophisticated clients who are increasingly seeking the “Netflixing” of wealth management advice, as reported by McKinsey.

The recent integration of two leading financial planning platforms, Redtail CRM and Coach Simple Finance, is driving the next generation of comprehensive financial services delivery. Building upon the best-in-class CRM, Coach Simple provides seamless integration to establish and improve automated pipeline, client onboarding and staff development.

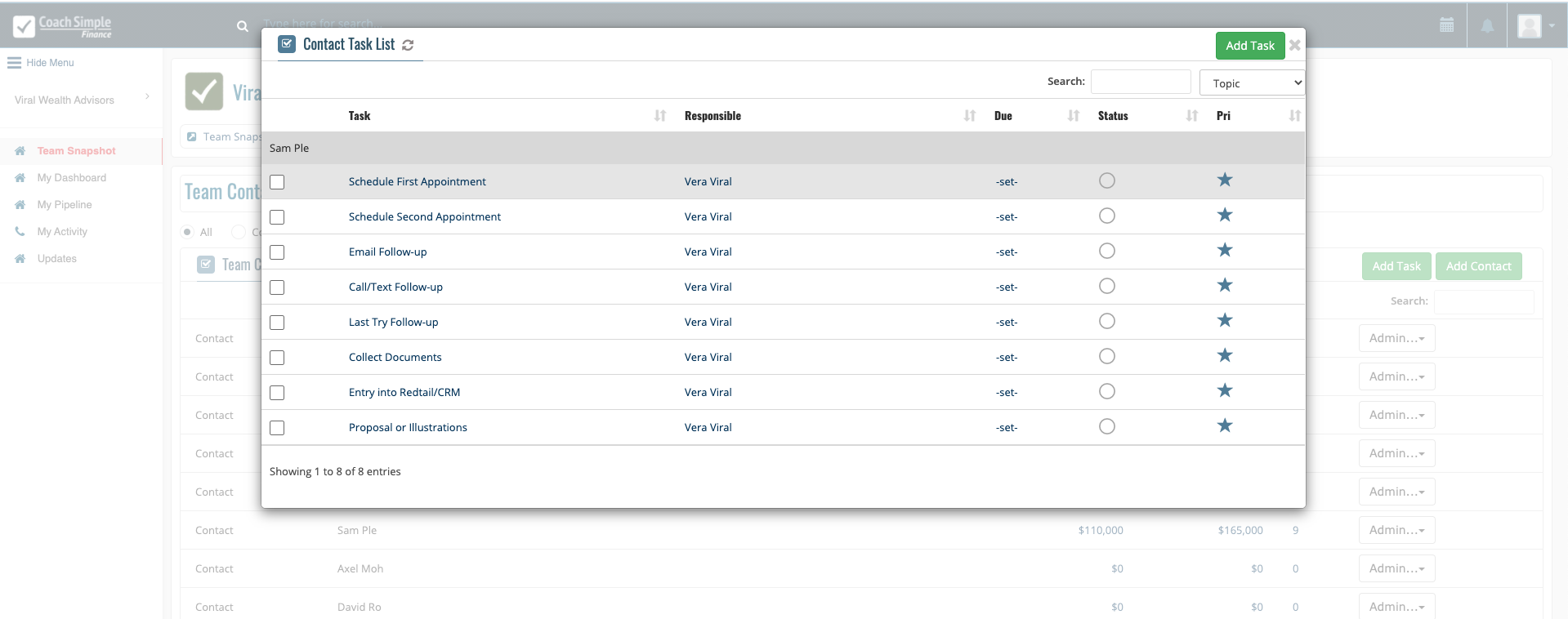

A key feature in improving client engagement is Coach Simple Action Plans, which automate common tasks at each stage of the sales pipeline. Action plans enable wealth managers and their staff to:

- add customized client onboarding action plans in a single click

- auto-assign action plan tasks to specific admins or virtual assistants

- set due dates, email and SMS reminders for any task ensuring key tasks get done

Add an Action Plan against any opportunity or contact

Sample Prospecting Action Plan

Wealth management client needs and expectations will continue to evolve in the increasingly digital personal and business landscapes. Organizing your team to provide high quality, comprehensive and consistent service will help ensure you generate more referrals and retain more customers.

Learn more about the key features of Coach Simple Finance and the Redtail CRM / Coach Simple Finance integration.